Yearly lump sum mortgage calculator

A borrower can make a one-time lump sum payment or increase his. It doesnt have to be recurring and a one-time lump sum payment helps with your mortgage payment and reduces the.

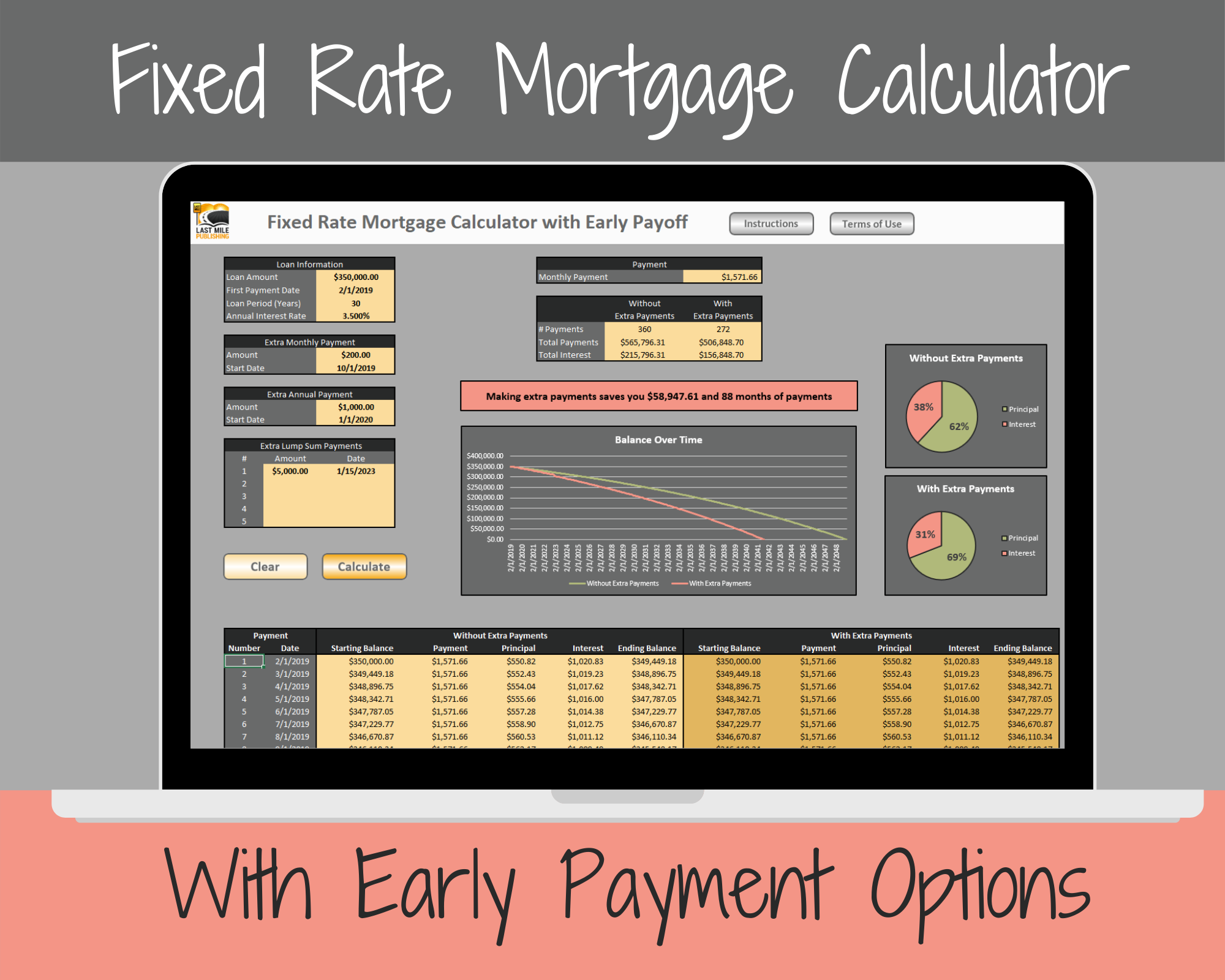

Ultimate Fixed Rate Mortgage Payoff Calculator Model Extra Payments Monthly Yearly Lump Sum Eloquens

Mortgage overpayment calculator Making mortgage overpayments simply means paying more towards your mortgage than the amount set by your lender.

. This lump sum is 10 of your initial value of your mortgage. The entire sum assured amount is paid at one go to the beneficiary of the term policy. For example- Sum assured 1 crore Payout Rs1 crore as a lump-sum payment to the beneficiary of the policy.

My new salary is 50k and the buy down is 25k. I have to take a pay cut but my company is offering buy down of the money I am loosing either a lump sum payment or paid in equal installments monthly for 24 months. Daily monthly or yearly interest compounding.

One such option is to make extra payments toward the principal. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Which option would be better to take and not incur too much tax.

You can even determine the impact of any principal prepayments. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Compound interest can have a dramatic effect on the growth of regular savings and lump sum deposits.

Here are other sources of lump sum funds to pay your loan faster. The lump sum due each month to your mortgage lender breaks down into several different items. The fees cover common charges such as.

You can put them to good use by paying down your mortgage. There is a limit of five non-recurrent lump-sum payments. We also generate graphs summaries of balances payments and interest over the life of your mortgage.

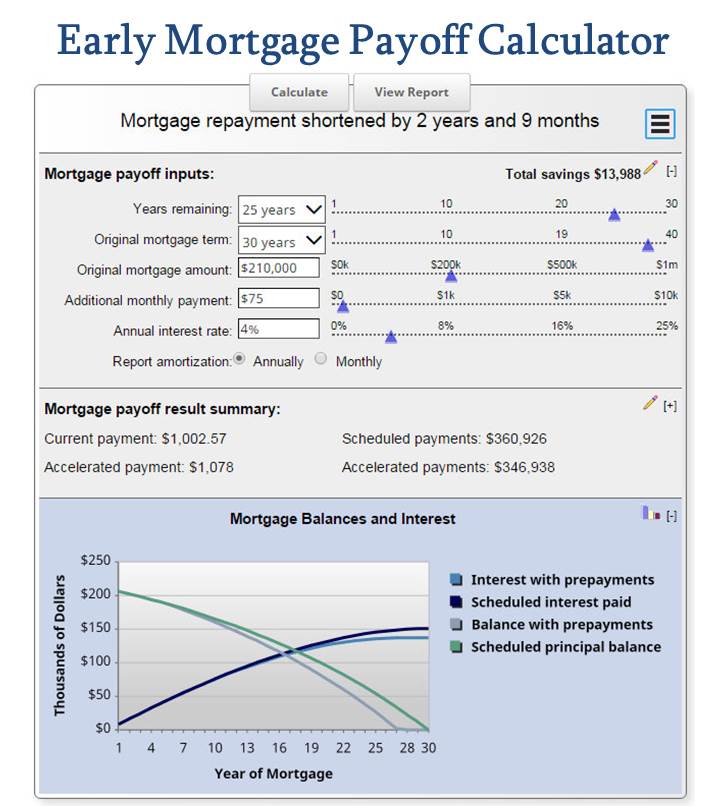

You can then use this extra cash to make a lump sum payment towards your principal. Press the report button for a full amortization schedule either by year or by month. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

The following is a yearly summary of your mortgage payments. Comparing mortgage terms ie. Our compound interest calculator includes options for.

Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. Another option available is to put 10 down yearly as a lump sum payment directly to your principal. You marry register a partnership or commence a de facto relationship recognised at law.

Use the above mortgage over. You can opt for a lump sum lump sum monthly income or income replacement or monthly income based on your requirements. Make a lump sum payment - If you get a bonus at year-end receive an inheritance or your stock investment has grown and you decided to cash in.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Use this calculator to determine the potential future value of your savings. In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture.

Daily monthly quarterly half-yearly and yearly compounding. You can also make one-time payments toward your principal with your yearly bonus from work tax refunds investment dividends or insurance payments. Should I refinance my mortgage.

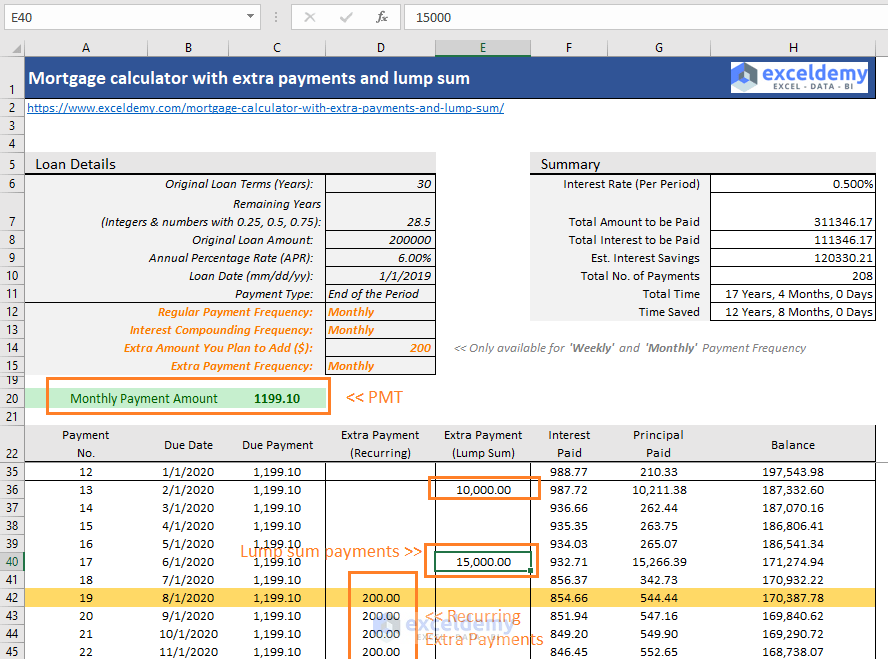

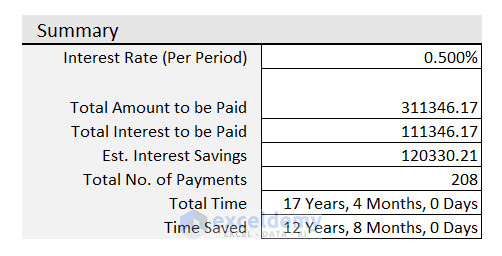

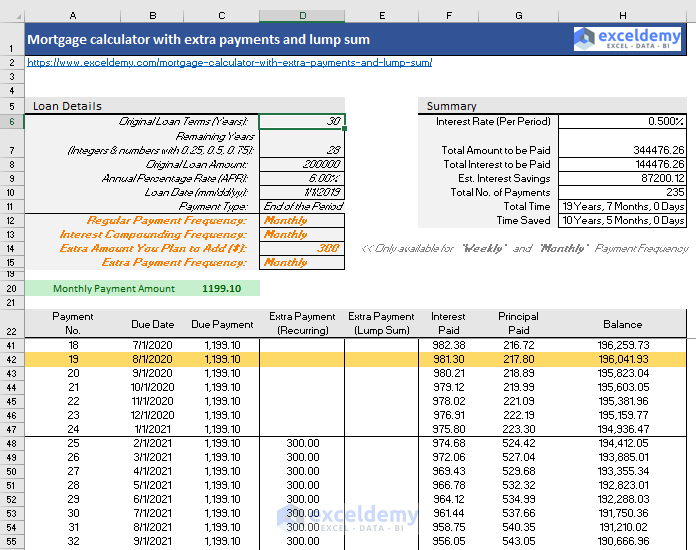

Mortgage loan basics Basic concepts and legal regulation. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Yearly Breakdown of Payments Lump Sums.

Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage. Life Cover pays a lump sum to your loved ones if you die or become terminally ill. If the consumer intends to borrow more than five separate lump sums over the course of the reverse mortgage we suggest you estimate the average yearly drawdown and put the amount under regular payments per year.

If you dont have sources for large funds you can budget for a lump sum payment every year. Generally HOA fees are charged monthly or yearly. The payment is applied during the third year of the loan.

It immediately reduces your principal compared to diminishing it in monthly increments. Quickly see how much interest you will pay and your principal balances. You take out or increase a mortgage on your primary place of residence.

This mortgage calculator gives a detailed breakdown of your mortgage and calculates payment schedules over your full amortization. Having this type of cover in place can help ensure your family will. 15 20 30 year Should I pay discount points for a lower interest rate.

12 payments yearly Semi-monthly 24 payments yearly Weekly 52 payments yearly. Apply a lump sum after an inheritance or other windfall. Your overpayment could be in the form of a one-off one lump sum or you could pay an extra amount each month on top of your usual repayments.

You may also enter extra lump sum and pre-payment amounts. This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about to buy a house with a mortgage loanAs the primal function it enables you to estimate your payment with different loan constructions and compare them alongside its connected costs especially its interest payments. An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage.

Most homebuyers have an escrow account which is the account your lender uses to pay your property tax bill and homeowners insurance. So for example if you had a 200000 mortgage you have the ability to put a 20000 lump sum directly to your principal every single year. 30-Year Fixed Mortgage Principal Loan Amount.

You can get a lump sum after receiving inheritance benefits or a windfall from a business venture. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. The following chart shows how much you can save based on a one-time lump-sum payment of 60000.

Get 247 customer support help when you place a homework help service order with us. Applying the money toward your mortgage will yield greater. If you would like to make a lump sum payment please select the amount next to the respective year.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This can be a lump-sum payment regular payments or both.

The lump sum payment would be made end of Dec. Generally speaking a loan is a lump sum of money that you can apply for through various financial institutions otherwise known as lenders. In addition you can include negative interest rates and inflation increases as part of your calculation.

Life Insurance calculator. Bankrates mortgage amortization schedule calculator can help you determine the impact of extra payments on your mortgage.

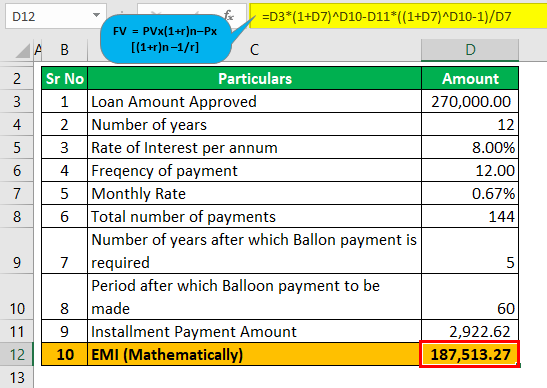

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Extra Payment Mortgage Calculator For Excel

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Mortgage Calculator For Extra Payments On Sale 51 Off Www Wtashows Com

Mortgage With Extra Payments Calculator

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

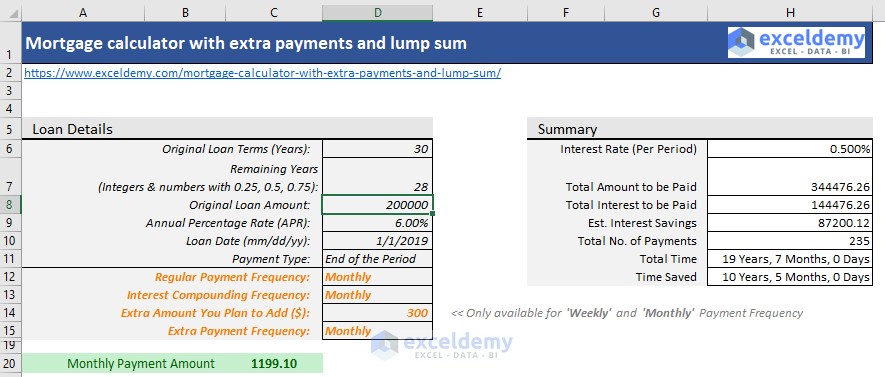

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

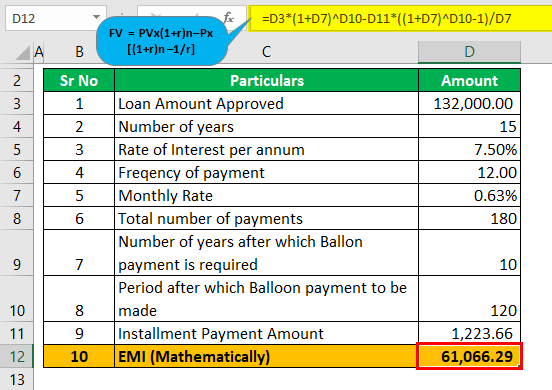

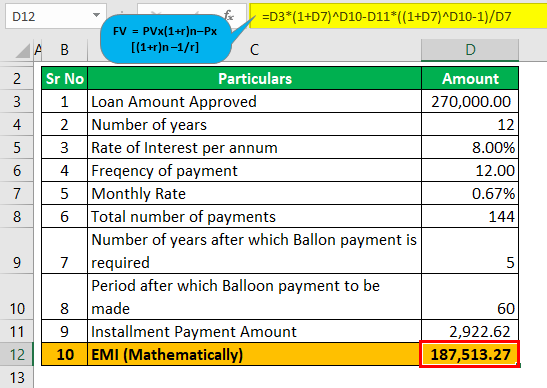

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

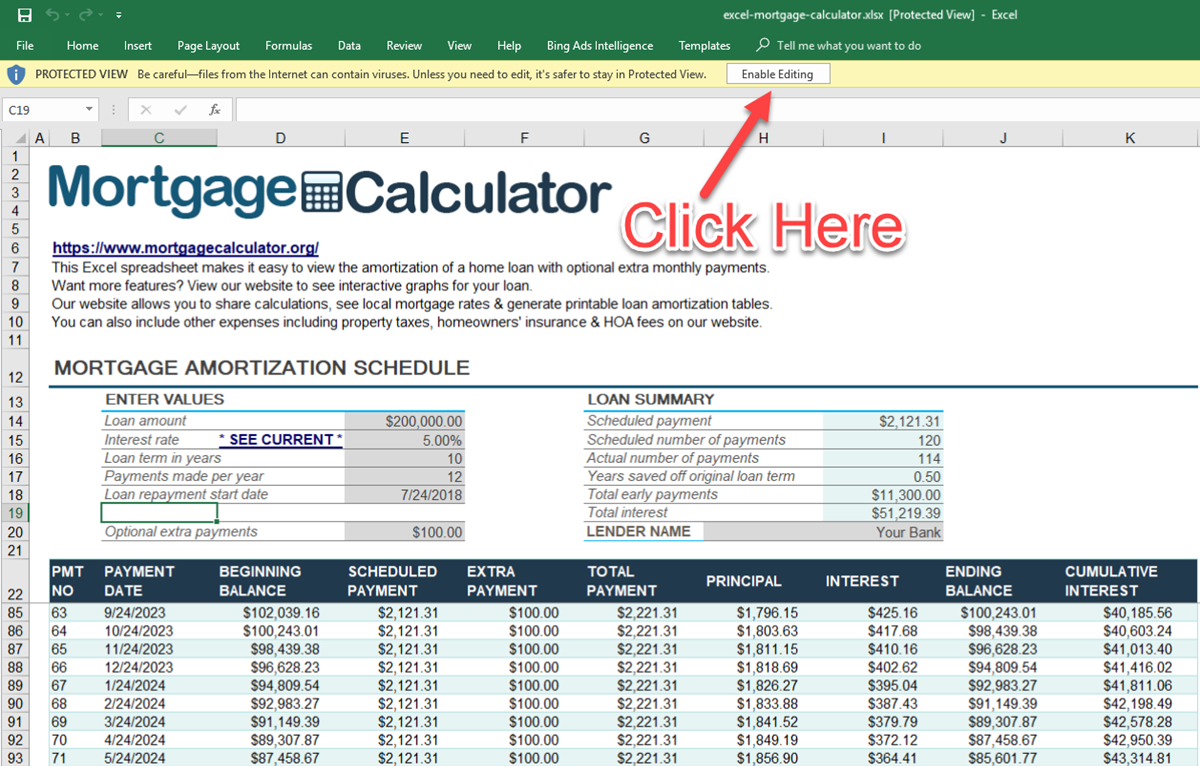

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Extra Payment Calculator Is It The Right Thing To Do

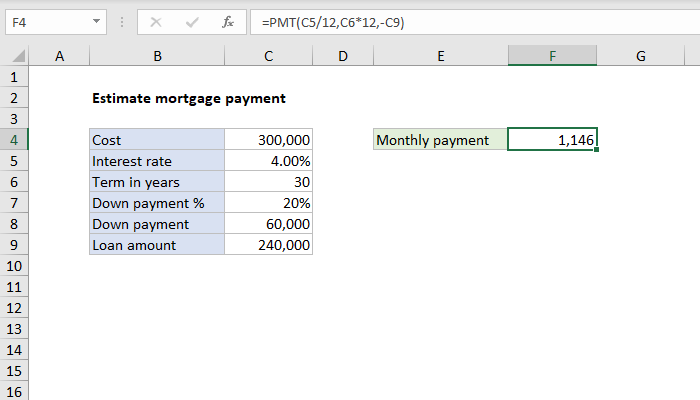

Excel Formula Estimate Mortgage Payment Exceljet

Balloon Mortgage Calculator How To Calculate Balloon Mortgage